Recent weeks have been frustrating for passengers in Europe and the US. Finally free to travel again, their pent-up demand has led to long lines at airports, lengthy delays and cancellations that turned connecting flight itineraries into obstacle courses. But what are the ramifications for air cargo, and how is the industry responding where there has been an impact?

Airlines have scrapped thousands of passenger flights this summer. Lufthansa has announced 900 flight cuts for July at its hubs at Frankfurt and Munich. Other carriers, like American Airlines and United, reduced their schedules months ago. Between two and four per cent of flights in the UK were cancelled in early June, while other European countries saw cancellation rates of around three per cent over the same period while the Netherlands suffered a bigger drop of 11 per cent.

Airport limits

In the face of these disruptions, some airports, including London Heathrow and Gatwick, have felt compelled to impose caps on flying. Amsterdam Schiphol, one of the hardest-hit hubs, announced a ceiling on flights during the summer peak that will see a 16 per cent reduction overall.

Robert Fordree, Vice-president Cargo at handler Menzies Aviation, says Europe has been the most affected region for these current disruptions. However, Steve Saxon, a Partner at McKinsey & Company who heads the consultancy’s aviation and logistics work in Asia, says airports around the globe – from Australia and India to Canada – have been also been impacted.

‘It’s a struggle everywhere. Every airline and airport is struggling to get capacity back in the air,’ he says, noting that even Singapore Changi has wrestled with extended delays.

After the furlough

They are all facing the same problem. Unlike in Hong Kong where quarantine restrictions remain (see below), passenger demand has rocketed back much faster than the operational capability of many airports and airlines, which has been severely depleted by the pandemic. Carriers, handlers and airports were forced to lay off large numbers of employees. Ramping up staff numbers again has proven to be challenging, while many laid-off workers have found employment elsewhere.

Moreover, the lengthy security clearance process for staff in airside positions deters possible candidates and slows down operators’ efforts to boost numbers to keep up with demand.

The good news for air-cargo so far is that handlers have not reported any significant impact to operations from the recent disruptions, although some in the industry point to the current higher airfreight rates being a factor of not just demand, but some handling bottlenecks too.

‘We see very stable operations,’ states a spokesman for Swissport. ‘There are some local issues here and there across the globe, but nothing that leads to very substantial issues.’

Minimal cargo impact

Unlike on the passenger side of the aviation industry, companies handling cargo did not lay off large numbers of employees who work with cargo during the pandemic, and demand has remained strong over the past couple of years, as McKinsey’s Saxon points out. Although he adds: ‘There has been a small knock-on effect from the fact that many handlers use the same labour to load cargo and passenger bags.’

The second major reason why cargo seems to be escaping the travails of the passenger side is that cancellations have overwhelmingly affected narrow-body flights on shorter sectors. With a few exceptions, European and American airlines have maintained their long-haul operations, so the impact of the flight cuts has been limited to some parcel traffic and a small scope of feeder operations.

‘The many flight cancellations being reported are largely short-haul, holiday flights that traditionally do not carry cargo or only in a very limited capacity,’ says Menzies’ Fordree. ‘They are generally narrow-body aircraft, so cargo payload is limited and impact on our global cargo operations is, therefore, minimal.’

Capacity fluctuations

Even so, cargo operations are under some strain. Saxon notes that operators are contending with a convergence of disruptions, in which the current flight cancellations are but the latest hiccup. The war in Ukraine reduced Russian freighter capacity on the Asia-Europe sector and has forced European carriers to take longer routings to avoid Russian airspace, effectively reducing payload. In addition, demand for airfreight has increased because shippers have been reluctant to use rail services from the Chinese Mainland to Europe via Russia, while the lockdowns in the Chinese Mainland decimated capacity and created a backlog of orders to be shipped.

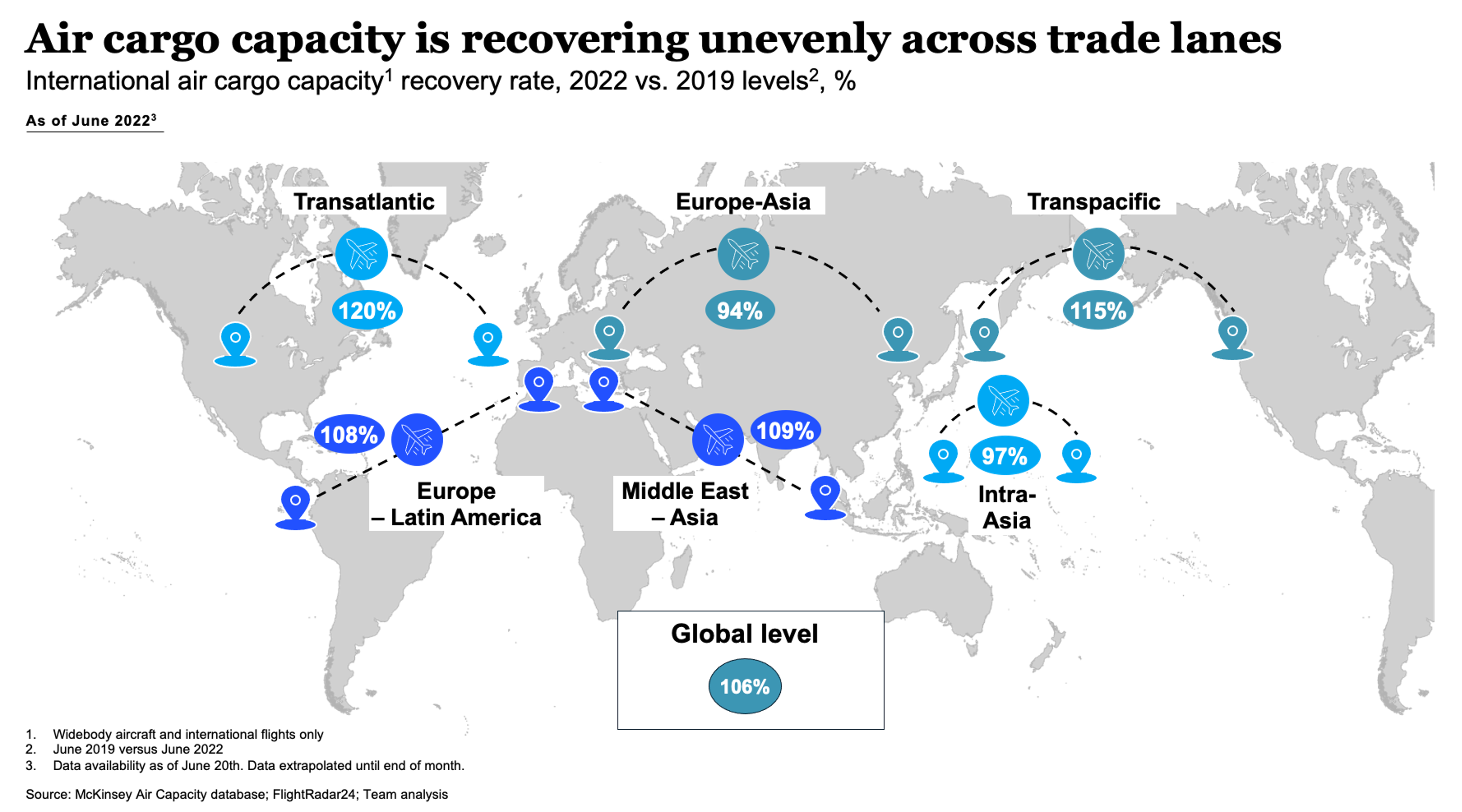

‘There remains a capacity shortage,’ says Saxon. ‘There is six per cent more capacity than in 2019. However, demand is higher.’ He adds that the strain on intermodal supply chains is maintaining upward pressure on demand for airlift.

The situation remains challenging for freight forwarders, according to Rene Brzezowsky, Corporate Director Product Management Air Cargo at Vienna-based forwarder cargo-partner. ‘We are facing an uncertain and volatile market situation and an increasing imbalance of supply and demand.’

As the situation has become more fluid in recent months, flexibility and close coordination with customers has become more important than ever, he stresses. Equally important are close contacts with airlines. ‘Long-term relationships with our carrier partners have enabled us to create reliable solutions for our customers based on fixed capacity agreements on major trade lanes,’ he adds.

Secondary airport contingencies

Like other forwarders, cargo-partner has used charters to ensure sufficient lift for its traffic. Over the past couple of years, as hubs struggled with heavy cargo volumes, a growing number of these flights have touched down at second-tier airports, some of which place a strong focus on cargo.

‘Traditional gateways became an even greater bottleneck during the pandemic,’ says Brzezowsky. ‘Of course, alternative airports are filling some gaps, but much more so on the charter operations side.’

This concept has taken off predominantly in North America and Europe, but it is also on the increase in Asia, notes Saxon, pointing to plans in China to develop Ezhou Huahu Airport in Hubei Province, the designated hub for SF Express, and Wuhu Xuanzhou airport in Anhui.

According to most industry sources, the problems caused at airports by the imbalance between passenger demand and ground resources will persist for months, if not more than a year. If passenger hubs impose more caps on flying to cope with the issue, we can expect the momentum to grow behind alternative cargo gateways.

Ian Putzger is an aviation and logistics journalist

The picture at Cathay Pacific Cargo

Have cargo operations been affected in Hong Kong by the passenger disruptions?

No. We have been providing all the resources needed to handle the available capacity. We liaise closely with Cathay Pacific Services Ltd on tonnage-demand forecasting, and our Cargo Terminal has a flexible workforce that can scale up and down as required. Our ground handling agent HAS is now providing dedicated support resources for our freighters.

As restrictions ease and flight numbers grow, will Cathay Pacific experience the bottlenecks we’ve seen elsewhere?

We have conducted a thorough evaluation of the cargo service providers around our network to ensure we have identified any potential capability issues in advance of new capacity being added. Our freighter schedule is very tight and optimised to deliver the greatest returns for the company in the months ahead, so we cannot afford to have significant delays or disruptions out of the normal tolerances over the second half of this year. It’s worth remembering that we have been operating freighters and cargo-only passenger flights throughout much of the pandemic to many places in the network, and so we will have fewer restart challenges as a result.

Are there reports of any challenges for cargo at outports?

Where there are issues, they have tended to be around a lack of skilled labour and hiring challenges to replace employees who left the industry during the pandemic. We will ensure all our compliance requirements are met through training and that skillsets are current so that we can put safety at the forefront when handling our customers’ cargo.

What mitigations do you have in place as the network rebuilds and we head towards the peak?

We undertook a thorough, deep-dive analysis of port capability and we have spoken to contractors where we identified issues and ensured appropriate actions have been taken in terms of meeting our standards and requirements. They have responded promptly to ensure we will not have any service breakdowns on the cargo side of the business. As we add cargo capacity, we will of course monitor our service levels very closely.